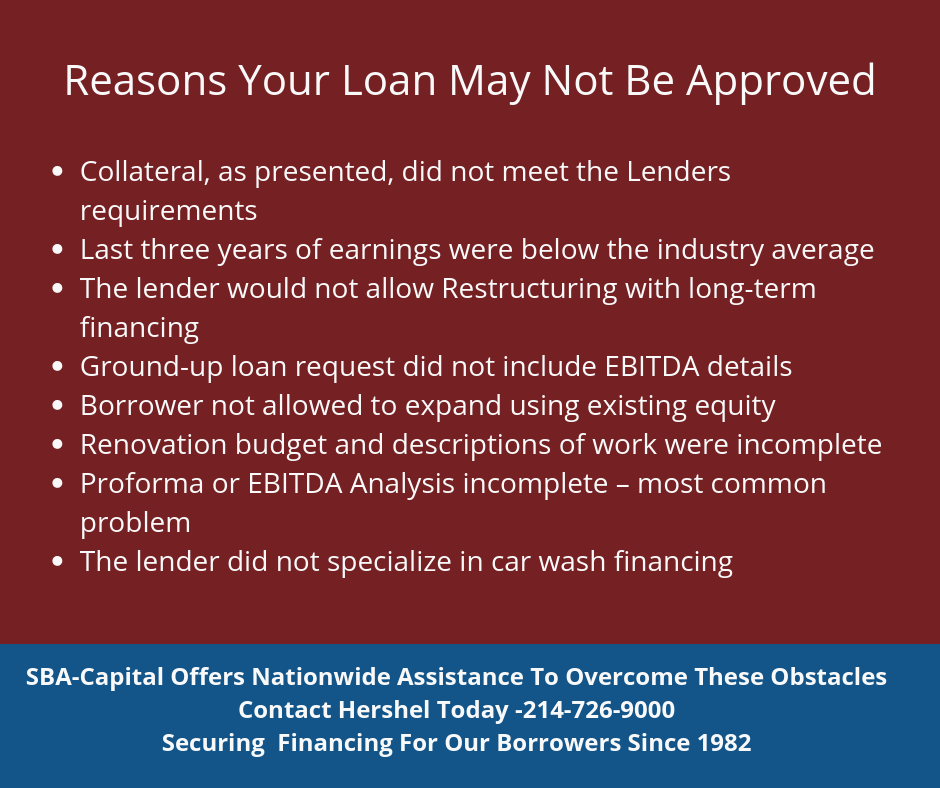

It is often thought that car wash funding is one of the most difficult to obtain and this can be very true. Car wash loans are often not approved due to a combination of reasons. Many of these loans would be approved if properly structured and underwritten. In this article we look at real examples where the borrower qualified, but the collateral (as presented) did not meet the lender’s requirements. These examples were selected because they occur nationwide daily.

Example: Financing to purchase an existing car wash declined.

Problem: The last three years earnings were below industry average because the equipment was obsolete and did not provide a quality wash for the customers.

Solution: A local distributor provided a renovation recommendation to update the equipment and issued a proforma. The proforma and our updated EBITDA spreadsheet showing gross income, EBITDA earnings, cash flow, ROI, debt service in dollar amounts, and debt service ratio percentage.

With the updated information, the lender approved the loan and included the cost of the improvements in the loan.

Example: Restructuring short-term loans to include equipment upgrades was not approved.

Reason: The lender insisted on keeping the $5.5 M loans on short term notes.

Solution: A new lender paid off the $5.5M existing loans plus included $1.5M for upgrading equipment. The new lender financed 100% of the $7M restructure due to the substantial equity in the properties. The outstanding debt increased $1.5M, and the monthly debt service was reduced significantly due to long term financing. The borrower now has the comfort level of successfully operating his business without constantly worrying about re-financing short term notes.

Example: Ground up construction financing denied.

Reason: The lender did not specialize in car wash financing and was concerned about the risk associated with new construction and they were also reluctant to make a loan for single purpose collateral.

Solution: Both concerns were valid for a lender that does not understand the car wash business. A lender that specializes in car wash loans reviewed the loan request that included our updated EBITDA spreadsheet and Proforma. After reviewing the data, the experienced lender was happy to make what they considered to be a well-secured safe and sound loan.

Example: Financing to construct a second car wash using the equity in the current wash not approved.

Reason: This lender’s loan policy states the borrower must invest “out of pocket” cash equity in each loan they make.

Solution: The lender that approved the loan reviewed the financial performance and current equity of the existing wash plus our EBITDA analysis and Proforma of the proposed car wash and allowed the borrower to use their current equity for a new loan to purchase another car wash.

Example: Financing to renovate and upgrade equipment denied.

Reason: Very common in our industry because banks are reluctant to invest additional dollars in a car wash that is not performing well.

Solution: Experienced car wash lenders will typically make the loan provided your loan request includes a complete and favorable cost analysis and proforma of the business along with a supporting budget by a respected local car wash distributor.

Experienced lenders consider this a safe loan because the borrow is established and respected in the community and plans to modernize their equipment to improve the quality of each washed car.

Anatomy Of A Successful Loan Application

Car wash borrower will enjoy better results when they are working with a lender that specializes in and understands the car wash business. The above examples also emphasize the importance of submitting a well-documented loan request package with support information that will enable the lender to properly document and underwrite the loan request.

Contact Hershel Pierce at pierce.pavbank@gmail.com or 214-726-9000 (mobile) for free consulting regarding financing to purchase an existing wash, renovating your existing wash, or construction and permanent loan financing.