3 Steps To Secure a Construction and Permanent Loan

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

Step 1 – How Does The Borrower Qualify? Complete and submit your Last three years’ tax returns. If you have other closely held companies, you will need to provide financial and tax returns on the company or companies. Secure a Free Proforma (prepared by your local car wash distributor) with revenue and earnings projections, how many cars you will wash each month, the traffic count for your location, and the estimated construction cost. (The Proforma is an invaluable tool)

Step 2 – Who Should The Borrower Consult With or Engage? Get acquainted with a local manufacturer rep familiar with your area. Confirm the City will allow you to construct a car wash on the property. Order an Environmental report to make sure the land is not contaminated and order a Certified Survey. Engage an Architect and Civil Engineering specializing in designing car washes. SBA-Capital provides Free Guidance.

Step 3 -What Role Does My General Contractor (GC) Play? Make sure your GC is well-qualified and has a history of performance. GC must have the financial capacity to complete your wash per the contract. Ask your GC to provide you with a list of the critical sub-contractors, and the GC must provide General Liability and Workman’s Comp. An itemized equipment list must be attached to your GC contract to ensure everyone, including the lender, understands the specific equipment included.

SBA-Capital provides Free Guidance on all of the above. Business Financing is what we do – Creating Custom Solutions is who we are

What are the current SBA interest rates?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

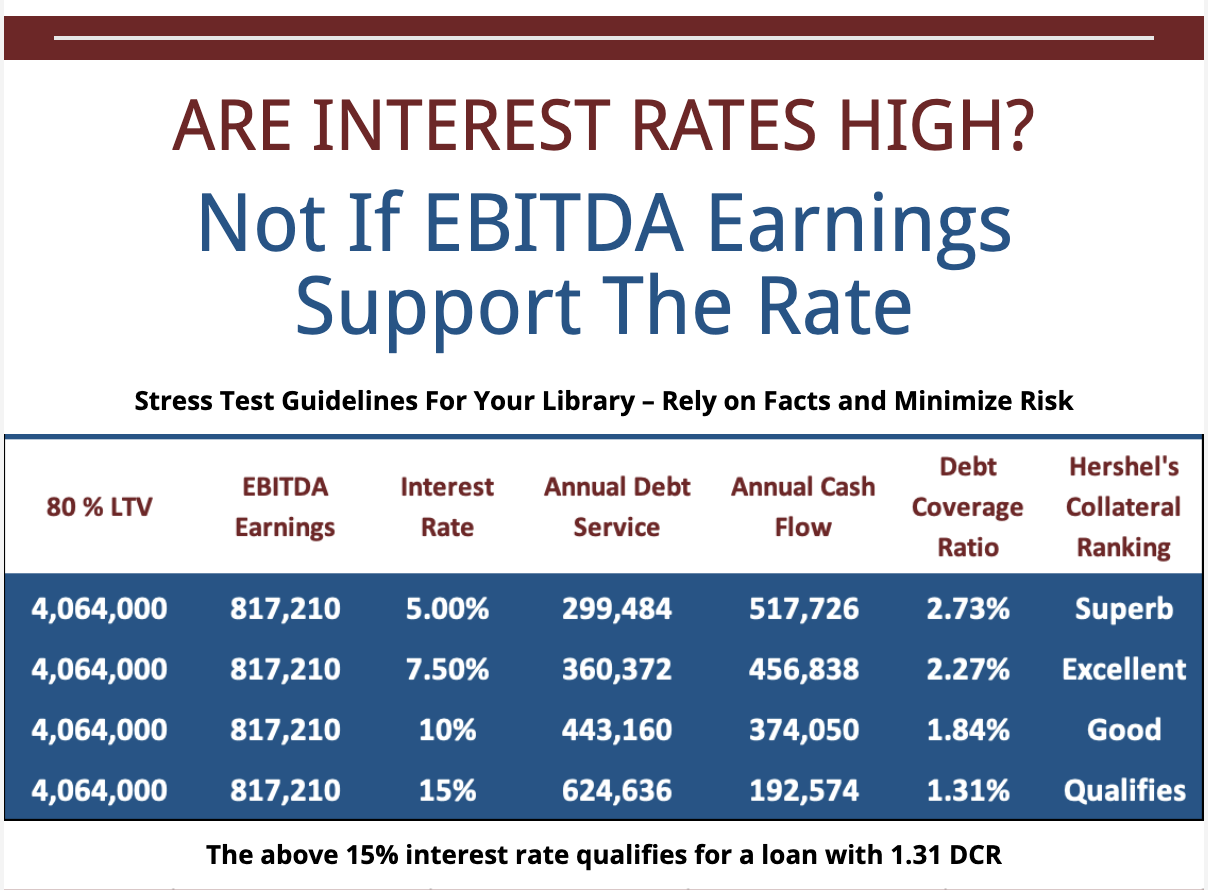

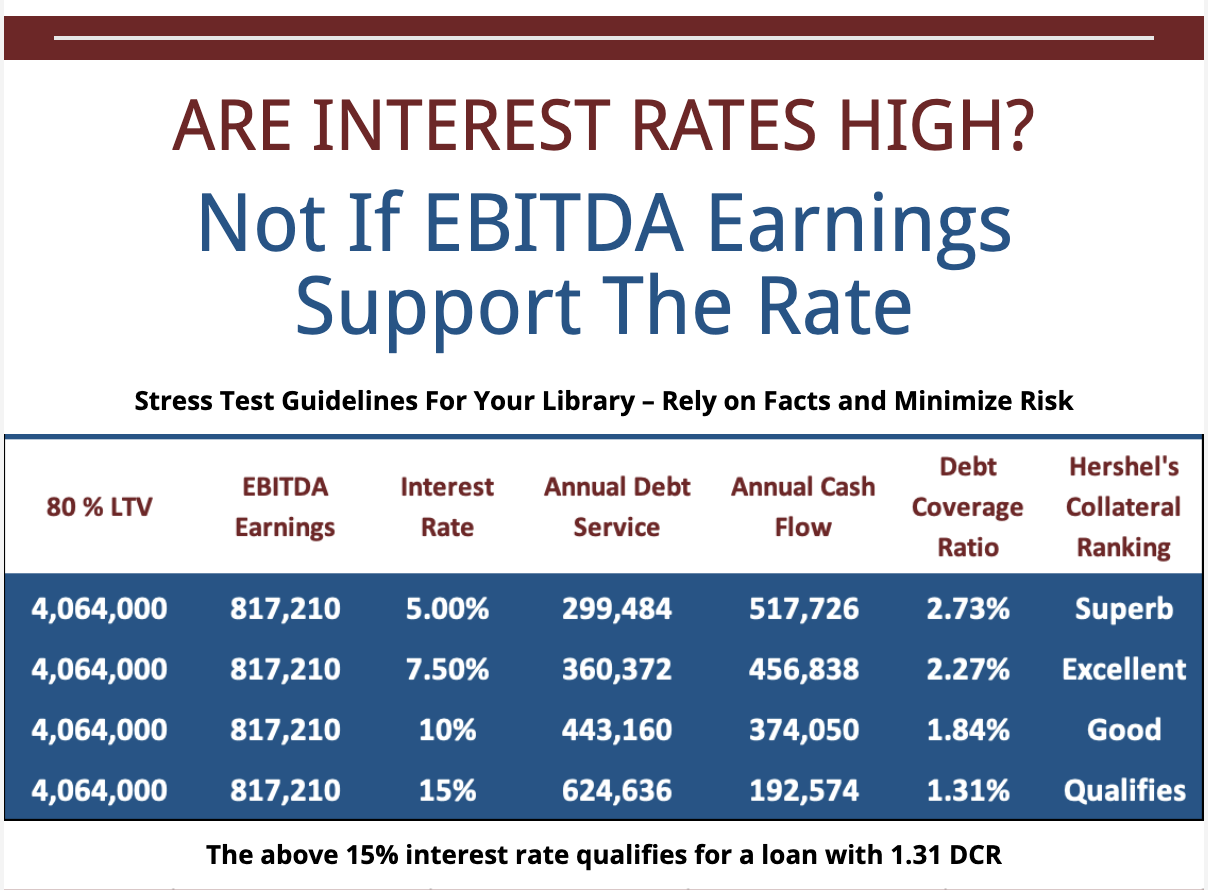

The interest rate for the most often used SBA 7a loan is Prime Rate plus 2.5%. Today’s Prime Rate is 8.5% making the current rate for SBA 7a loans 11%. Your rate will adjust each quarter based on the movement of the prime rate.

Because the above EBITDA of $817,210 is high for this wash, The 15% interest rate qualifies for a loan with a 1.31 DCR

Conclusion: High EBITDA Earnings help mitigate high-interest rates

**For your Investment Library – Thirty-year history of Prime Rate Above

How can I select the best loan?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

CREATING THE BEST LOAN OPTION FOR YOUR INVESTMENT

Five Tools Our Software Uses to Analyze an Existing Loan

Visit our Car Wash Industry White Paper with Comprehensive Reviews and Case Studies

Hershel will work with you from creating the best loan request until closing.

Why are some loans not approved?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

Solutions to some Common Reasons why Business Loans are not approved

Business Financing is what we do – Creating Custom Solutions is who we are

Do I qualify for an SBA loan?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

If you are a U S Citizen or have a Green Card.

If you have never defaulted on an SBA loan, including student loans.

If you have credit score of 650 or more; can vary depending on incorrect information the Credit Bureau is working with.

Please note: SBA-Capital’s Minimum loan is $500K. Please Google SBA Express loans If you need a smaller loan.

Contact Hershel at SBA-Capital for Free Guidance

Can I use my IRA to fund my SBA equity?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

YES! you can use your IRA for SBA Loan Equity to start or expand your business and increase your working capital.

You must engage a trust company, such as Millennium Trust or Equity Trust, specializing in being a Custodian Trust for Self-Directed IRA accounts. Your money always remains in your possession which you control 100% with the Trust serving as your Custodian Manager. The Trust is also responsible for filing your annual tax return with the IRS as part of their service agreement.

Two of the largest Trust Companies provide the above “Trust Service.”

Business Financing is what we do – Creating Custom Solutions is who we are

How can I manage interest rate volatility?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

Manage Interest Rate Volatility with our popular

SBA 504 7.32% Blended RateToo

- Re-Fi 100% of your current loan

- Cash-out with Re-Fi depending on the appraisal

- Use the 504 Program to purchase an existing wash

- Purchase and renovate a wash using the 504 Program

- Use the 504 Program for ground-up construction

- Grow your Portfolio

WE STRESS-TEST THE FINANCIAL HEALTH OF YOUR LOANS

Are car wash renovations profitable?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

CAR WASH RENOVATION IS A RAPIDLY GROWING AND PROFITABLE MARKET – ( see details below, with videos )

Visit This Link For Some Real World CAR WASH RENOVATIONS

SBA-Capital Specializes In Car Wash Renovation Loans Our Free Ebitda Analysis Will Immediately Determine If 100% Financing Is Available For Your Renovation.

Loans Available Now To Renovate Your Existing Wash Or Purchase And Renovate An Existing Wash We Included The Purchase Price And Renovation Cost In Your Loan.

What does a proforma for renovation or new build include?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

Distributors for car wash manufacturers throughout the US will provide a free computerized proforma for your existing car wash renovation or ground-up construction on a specific site. You receive invaluable statistical data and become acquainted with your local distributor with years of experience in the car wash business in your area.

SBA-Capital uses the above information in our proprietary EBITA analysis to determine if the car wash will qualify for a loan and, most importantly, if this is a good investment for you.

Your Manufacturer’s Proforma Includes:

- A computerized evaluation, including a personal visit to the site

- The estimate cost to renovate or ground up construction

- Traffic count, including the speed limit at your site

- Number of projected cars washed daily, monthly, and annually

- Projected revenue for cars washed daily, monthly and annually

- Estimated variable and a fixed cost to operate your car wash

- Analysis of competition near you

- Ingress and egress to your specific site

- Demographics for the neighborhood

Invite a Sonny’s Car wash Factory’s Representative in your State to visit your site and create a Free Proforma

Should I select an SBA or conventional loan?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

Congress established SBA Business Loans to create jobs for our economy and assist borrowers who may not qualify for traditional bank loans requiring enormous equity contributions.

Lower equity and more extended repayment: Equity for SBA loans ranges from 10 to 20%, depending on your experience in the respective industry, and the loan will be for 25 years to help reduce your monthly payments. A typical conventional loan requires 30 to 35% equity and is usually only five to seven years in duration.

Experienced SBA Lender: Select an experienced banker throughout the SBA underwriting and closing process to make sure you secure the best possible loan for your short and long-term needs. A qualified, experienced lender will underwrite and process your loan expeditiously so you will enjoy a timely and desirable closing.

Do I qualify for an SBA Loan: Contact SBA-Capital, and we will evaluate your loan needs and immediately let you know if you meet the SBA requirements for the business loan you request. Hershel at SBA-Capital for Free Guidance

Can I refinance my business debt and cash out equity?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

We did a $7M Re-Fi and, cashed out $1.5 to renovate, & reduced monthly payments over $20K. You can learn more here

SBA-Capital Provides Game Changing Restructure Loan for All American Car Wash & Lube

SBA-Capital lenders provide financing for the Mini Tunnel and the Express Tunnel because the financial performance of both are superb.

Renovation Doubles Car Wash Revenue & Increases Revenue For “C” Store

Tools to Help Minimize Risk

👉 Stress Test Your Future and Present Loans

👉 EBITDA Analysis and Debt Coverage Ratio

👉 Business Loans | Customized Business Loans

👉 Hospitality Library $2M to $25M

Contact Hershel for a Quick and Free Analysis of your Financing Needs

Business Financing is what we do – Creating Custom Solutions is who we are

Can I secure 100% financing to purchase, renovate, re-fi, or build?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

We provided 100% Refinancing for a $1.9M Business Loan and reduced monthly payments by $3,500. See details regarding our SBA 504 Refinance Program.

Our SBA 504 RE-Fi Program allowed us to Re-Fi 100% of our Borrower’s $4M Business Debt, plus $400K cash out with our 7.32% SBA 504 Blended rate.

We provided 100% financing for a $5M restructure to renovate existing facilities and acquire other Properties.

I can’t thank everyone at SBA-Capital, enough for making this possible. Working with you, Mike, Steve, Judy, Abigail, and Roxie were terrific. You guys made it a very smooth and easy process. We’re very excited about what the funds, and our vendors, were able to accomplish in just 42 days! Big Man was a pleasure to work with, and we look forward to what we can now offer. Once again, we send our gratitude to all that made this possible.

Larry Ayers Owner, All American Car Wash & Lube

Thanks to Larry Ayres for allowing us to provide 100% financing for his $7M restructuring, including $1.5M cash out for renovation plus, we reduced his debt service by over $20K monthly. See more details at Game-Changing Restructure.

Contact Hershel at SBA-Capital for free guidance

How do you determine the value of a proposed purchase?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

RELY ON THE FOLLOWING SEVEN LINKS TO HELP DETERMINE YOUR CAR WASH EARNINGS BEFORE YOU PURCHASE OR BUILD

Thinking of purchasing an existing business?

Restructure can be a Game-changer.

Project EBITDA Earnings for a new or existing business

Successful Renovation Options (Three with videos)

Stress Test the loans you are considering.

Secure a Proforma for renovation or ground-up construction.

More tools to help you Minimize Risk

Any Questions – Contact Hershel at pierce.pavbank@gmail.com or 214-726-9000 Mobile

Business Financing is what we do – Creating Custom Solutions is who we are

Is equity required for my first loan?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

The equity required is 10% If you have owned a similar business. If you have never owned a business in this specific industry, SBA requires 20% equity. If you have equity in other business entities such as rent houses, etc., SBA will allow you to put 10% cash down and monetize up to 10% of your rental property.

Assume you have a limited partner or partners: SBA considers anyone with less than 20% ownership a limited partner and anyone with 20% or more ownership a full partner. The limited partners can contribute most of the equity, assuming both limited and full partners agree in their partnership agreement. SBA does not require the “percent of equity contribution equates to the percent of ownership.” Full partners must sign the note, but limited partners have no personal liability.

Use Your IRA For SBA Loan Equity to Start or Expand Your Business and Increase Your Working Capital. The concept is one of the best-kept secrets in the industry and easy to accomplish, assuming you follow the correct procedure. SBA-Capital will provide information allowing you to access this resource. Use these funds to make investments, start your own business, plus raise working capital to operate your business.

See Four Ways to Raise Equity & Keep 100% of your company.

100% expansion financing: If you have equity in your existing business SAB-Capital can likely finance 100% of your expansion loan. Contact Hershel Pierce for details.

Business Financing is what we do – Creating Custom Solutions is who we are

How do I calculate my EBITDA earnings and debt coverage ratio?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

Use the following examples to calculate your EBITDA and DCR, or contact Hershel.

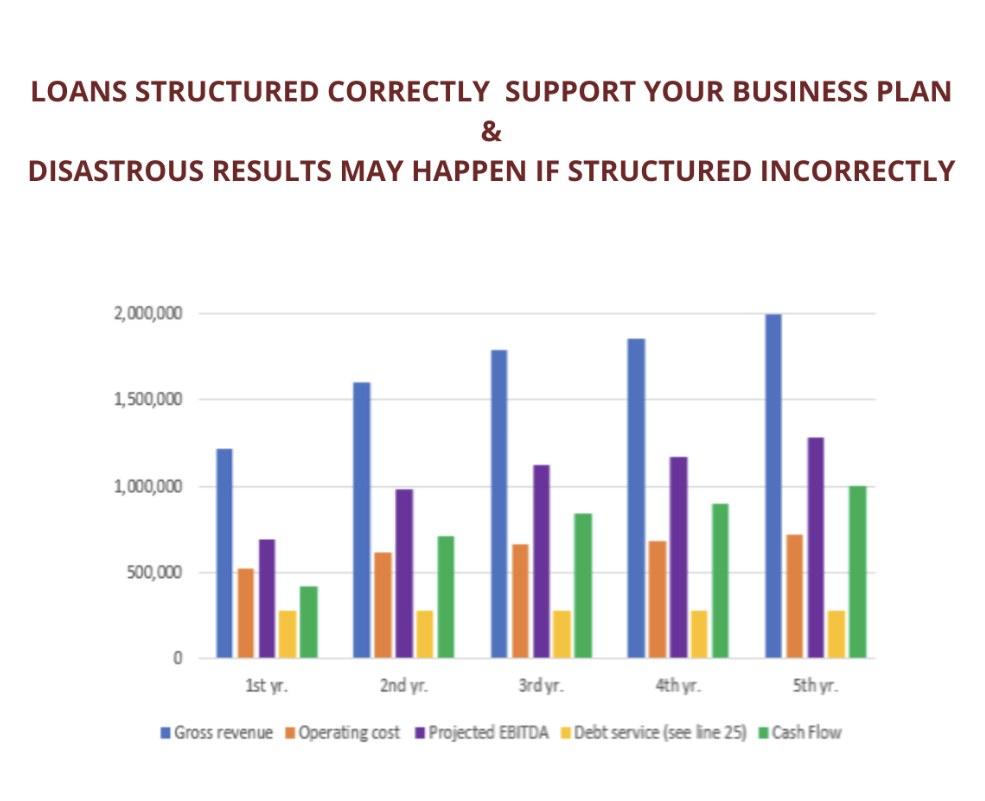

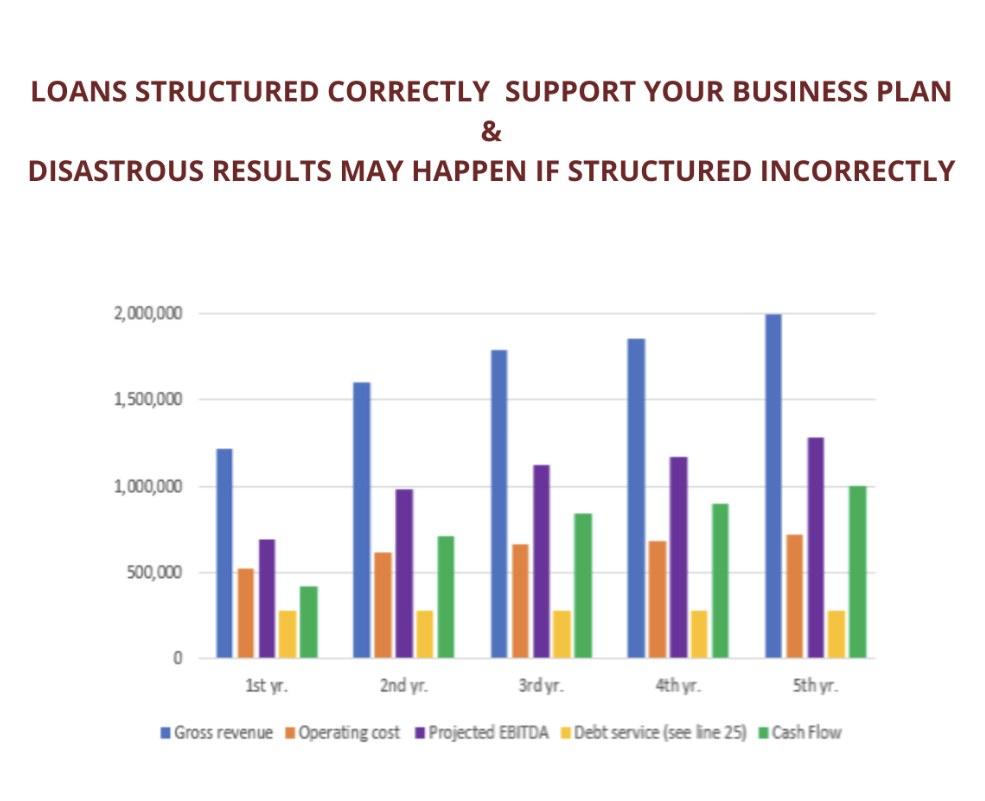

First-year EBITDA is $291,957 – projects an increase of 5% in the four subsequent years.

Learn more about EBITDA Analysis – Contact Hershel at SBA-Capital for your free analysis today.

Listen to Hershel talk deeper about EBITDA in this Lenders Roundtable Discussion

3 Steps To Secure a Construction and Permanent Loan

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

Step 1 – How Does The Borrower Qualify? Complete and submit your Last three years’ tax returns. If you have other closely held companies, you will need to provide financial and tax returns on the company or companies. Secure a Free Proforma (prepared by your local car wash distributor) with revenue and earnings projections, how many cars you will wash each month, the traffic count for your location, and the estimated construction cost. (The Proforma is an invaluable tool)

Step 2 – Who Should The Borrower Consult With or Engage? Get acquainted with a local manufacturer rep familiar with your area. Confirm the City will allow you to construct a car wash on the property. Order an Environmental report to make sure the land is not contaminated and order a Certified Survey. Engage an Architect and Civil Engineering specializing in designing car washes. SBA-Capital provides Free Guidance.

Step 3 -What Role Does My General Contractor (GC) Play? Make sure your GC is well-qualified and has a history of performance. GC must have the financial capacity to complete your wash per the contract. Ask your GC to provide you with a list of the critical sub-contractors, and the GC must provide General Liability and Workman’s Comp. An itemized equipment list must be attached to your GC contract to ensure everyone, including the lender, understands the specific equipment included.

SBA-Capital provides Free Guidance on all of the above. Business Financing is what we do – Creating Custom Solutions is who we are

What are the current SBA interest rates?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

The interest rate for the most often used SBA 7a loan is Prime Rate plus 2.5%. Today’s Prime Rate is 8.5% making the current rate for SBA 7a loans 11%. Your rate will adjust each quarter based on the movement of the prime rate.

Because the above EBITDA of $817,210 is high for this wash, The 15% interest rate qualifies for a loan with a 1.31 DCR

Conclusion: High EBITDA Earnings help mitigate high-interest rates

**For your Investment Library – Thirty-year history of Prime Rate Above

How can I select the best loan?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

CREATING THE BEST LOAN OPTION FOR YOUR INVESTMENT

Five Tools Our Software Uses to Analyze an Existing Loan

Visit our Car Wash Industry White Paper with Comprehensive Reviews and Case Studies

Hershel will work with you from creating the best loan request until closing.

Why are some loans not approved?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

Solutions to some Common Reasons why Business Loans are not approved

Business Financing is what we do – Creating Custom Solutions is who we are

Do I qualify for an SBA loan?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

If you are a U S Citizen or have a Green Card.

If you have never defaulted on an SBA loan, including student loans.

If you have credit score of 650 or more; can vary depending on incorrect information the Credit Bureau is working with.

Please note: SBA-Capital’s Minimum loan is $500K. Please Google SBA Express loans If you need a smaller loan.

Contact Hershel at SBA-Capital for Free Guidance

Can I use my IRA to fund my SBA equity?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

YES! you can use your IRA for SBA Loan Equity to start or expand your business and increase your working capital.

You must engage a trust company, such as Millennium Trust or Equity Trust, specializing in being a Custodian Trust for Self-Directed IRA accounts. Your money always remains in your possession which you control 100% with the Trust serving as your Custodian Manager. The Trust is also responsible for filing your annual tax return with the IRS as part of their service agreement.

Two of the largest Trust Companies provide the above “Trust Service.”

Business Financing is what we do – Creating Custom Solutions is who we are

How can I manage interest rate volatility?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

Manage Interest Rate Volatility with our popular

SBA 504 7.32% Blended RateToo

- Re-Fi 100% of your current loan

- Cash-out with Re-Fi depending on the appraisal

- Use the 504 Program to purchase an existing wash

- Purchase and renovate a wash using the 504 Program

- Use the 504 Program for ground-up construction

- Grow your Portfolio

WE STRESS-TEST THE FINANCIAL HEALTH OF YOUR LOANS

Are car wash renovations profitable?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

CAR WASH RENOVATION IS A RAPIDLY GROWING AND PROFITABLE MARKET – ( see details below, with videos )

Visit This Link For Some Real World CAR WASH RENOVATIONS

SBA-Capital Specializes In Car Wash Renovation Loans Our Free Ebitda Analysis Will Immediately Determine If 100% Financing Is Available For Your Renovation.

Loans Available Now To Renovate Your Existing Wash Or Purchase And Renovate An Existing Wash We Included The Purchase Price And Renovation Cost In Your Loan.

What does a proforma for renovation or new build include?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

Distributors for car wash manufacturers throughout the US will provide a free computerized proforma for your existing car wash renovation or ground-up construction on a specific site. You receive invaluable statistical data and become acquainted with your local distributor with years of experience in the car wash business in your area.

SBA-Capital uses the above information in our proprietary EBITA analysis to determine if the car wash will qualify for a loan and, most importantly, if this is a good investment for you.

Your Manufacturer’s Proforma Includes:

- A computerized evaluation, including a personal visit to the site

- The estimate cost to renovate or ground up construction

- Traffic count, including the speed limit at your site

- Number of projected cars washed daily, monthly, and annually

- Projected revenue for cars washed daily, monthly and annually

- Estimated variable and a fixed cost to operate your car wash

- Analysis of competition near you

- Ingress and egress to your specific site

- Demographics for the neighborhood

Invite a Sonny’s Car wash Factory’s Representative in your State to visit your site and create a Free Proforma

Should I select an SBA or conventional loan?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

Congress established SBA Business Loans to create jobs for our economy and assist borrowers who may not qualify for traditional bank loans requiring enormous equity contributions.

Lower equity and more extended repayment: Equity for SBA loans ranges from 10 to 20%, depending on your experience in the respective industry, and the loan will be for 25 years to help reduce your monthly payments. A typical conventional loan requires 30 to 35% equity and is usually only five to seven years in duration.

Experienced SBA Lender: Select an experienced banker throughout the SBA underwriting and closing process to make sure you secure the best possible loan for your short and long-term needs. A qualified, experienced lender will underwrite and process your loan expeditiously so you will enjoy a timely and desirable closing.

Do I qualify for an SBA Loan: Contact SBA-Capital, and we will evaluate your loan needs and immediately let you know if you meet the SBA requirements for the business loan you request. Hershel at SBA-Capital for Free Guidance

Can I refinance my business debt and cash out equity?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

We did a $7M Re-Fi and, cashed out $1.5 to renovate, & reduced monthly payments over $20K. You can learn more here

SBA-Capital Provides Game Changing Restructure Loan for All American Car Wash & Lube

SBA-Capital lenders provide financing for the Mini Tunnel and the Express Tunnel because the financial performance of both are superb.

Renovation Doubles Car Wash Revenue & Increases Revenue For “C” Store

Tools to Help Minimize Risk

👉 Stress Test Your Future and Present Loans

👉 EBITDA Analysis and Debt Coverage Ratio

👉 Business Loans | Customized Business Loans

👉 Hospitality Library $2M to $25M

Contact Hershel for a Quick and Free Analysis of your Financing Needs

Business Financing is what we do – Creating Custom Solutions is who we are

Can I secure 100% financing to purchase, renovate, re-fi, or build?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

We provided 100% Refinancing for a $1.9M Business Loan and reduced monthly payments by $3,500. See details regarding our SBA 504 Refinance Program.

Our SBA 504 RE-Fi Program allowed us to Re-Fi 100% of our Borrower’s $4M Business Debt, plus $400K cash out with our 7.32% SBA 504 Blended rate.

We provided 100% financing for a $5M restructure to renovate existing facilities and acquire other Properties.

I can’t thank everyone at SBA-Capital, enough for making this possible. Working with you, Mike, Steve, Judy, Abigail, and Roxie were terrific. You guys made it a very smooth and easy process. We’re very excited about what the funds, and our vendors, were able to accomplish in just 42 days! Big Man was a pleasure to work with, and we look forward to what we can now offer. Once again, we send our gratitude to all that made this possible.

Larry Ayers Owner, All American Car Wash & Lube

Thanks to Larry Ayres for allowing us to provide 100% financing for his $7M restructuring, including $1.5M cash out for renovation plus, we reduced his debt service by over $20K monthly. See more details at Game-Changing Restructure.

Contact Hershel at SBA-Capital for free guidance

How do you determine the value of a proposed purchase?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

RELY ON THE FOLLOWING SEVEN LINKS TO HELP DETERMINE YOUR CAR WASH EARNINGS BEFORE YOU PURCHASE OR BUILD

Thinking of purchasing an existing business?

Restructure can be a Game-changer.

Project EBITDA Earnings for a new or existing business

Successful Renovation Options (Three with videos)

Stress Test the loans you are considering.

Secure a Proforma for renovation or ground-up construction.

More tools to help you Minimize Risk

Any Questions – Contact Hershel at pierce.pavbank@gmail.com or 214-726-9000 Mobile

Business Financing is what we do – Creating Custom Solutions is who we are

Is equity required for my first loan?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

The equity required is 10% If you have owned a similar business. If you have never owned a business in this specific industry, SBA requires 20% equity. If you have equity in other business entities such as rent houses, etc., SBA will allow you to put 10% cash down and monetize up to 10% of your rental property.

Assume you have a limited partner or partners: SBA considers anyone with less than 20% ownership a limited partner and anyone with 20% or more ownership a full partner. The limited partners can contribute most of the equity, assuming both limited and full partners agree in their partnership agreement. SBA does not require the “percent of equity contribution equates to the percent of ownership.” Full partners must sign the note, but limited partners have no personal liability.

Use Your IRA For SBA Loan Equity to Start or Expand Your Business and Increase Your Working Capital. The concept is one of the best-kept secrets in the industry and easy to accomplish, assuming you follow the correct procedure. SBA-Capital will provide information allowing you to access this resource. Use these funds to make investments, start your own business, plus raise working capital to operate your business.

See Four Ways to Raise Equity & Keep 100% of your company.

100% expansion financing: If you have equity in your existing business SAB-Capital can likely finance 100% of your expansion loan. Contact Hershel Pierce for details.

Business Financing is what we do – Creating Custom Solutions is who we are

How do I calculate my EBITDA earnings and debt coverage ratio?

Real World Case Studies Business Loans EBITDA Analysis Newsletter Library

Use the following examples to calculate your EBITDA and DCR, or contact Hershel.

First-year EBITDA is $291,957 – projects an increase of 5% in the four subsequent years.

Learn more about EBITDA Analysis – Contact Hershel at SBA-Capital for your free analysis today.

Listen to Hershel talk deeper about EBITDA in this Lenders Roundtable Discussion