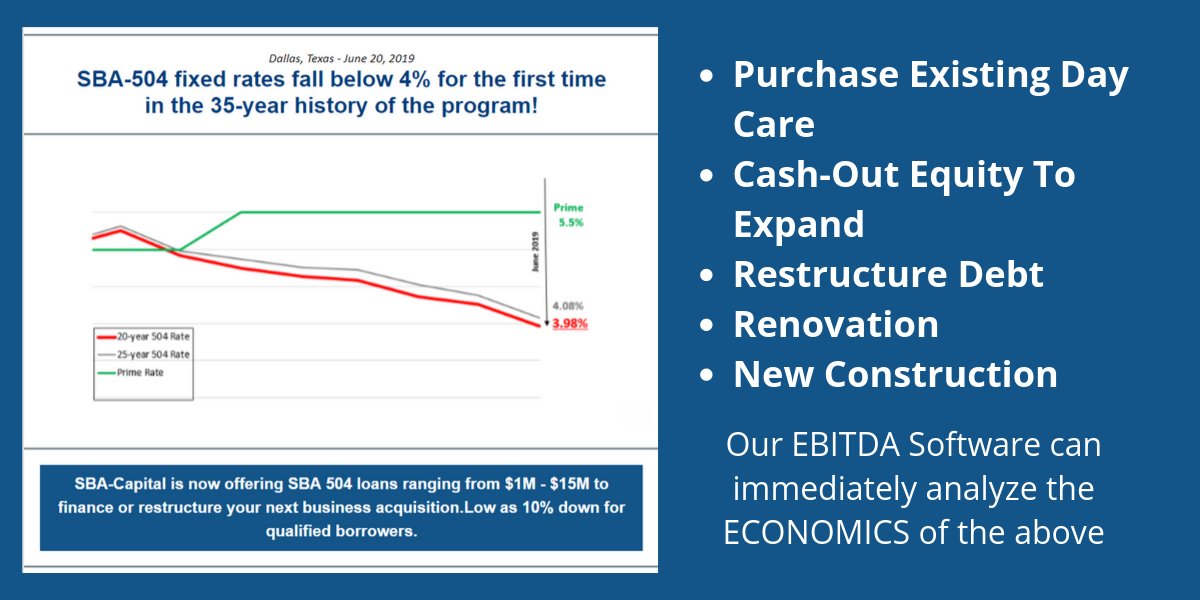

Day Care Financing

TAKE ADVANTAGE OF RECORD LOW RATES

RESTRUCTURE – USE EQUITY IN EXISTING PROPERTIES TO EXPAND

Request a spreadsheet analysis and EBITDA print out showing your revenue, cost of goods, cash flow, and the all-important “DEBT COVERAGE RATIO.”

Typical Loan used: SBA 7a is most popular because you can include closing cost, working capital, and construction interest

Max Amount of Loan: $5,000,000 for SBA 7a

Amount Down: Typically 10 to 20%

Length of Loan: 25 years

How Funds are used: Available for Ground Up Construction or Existing Property

Do I qualify for loan: Contact SBA-Capital for free pre-approval and loan review

Cost of loan: Depends on experience, amount down, etc. Contact us for details

Most popular loan: SBA 7a (includes closing cost, construction interest, & working capital)

Certified Green Construction included in loan if approved in original budget.

Comments about SBA loans:

1. All funds are provided by the bank. SBA only provides a guarantee.

2. Some say SBA loans are complicated and take too long which is true unless you are working with a loan official that is experienced and knows how to process the loan.

3. Banks had $585 billion dollars in outstanding SBA loans in 2013 simply because SBA guaranteed part of the loan. The staggering numbers show the popularity of SBA loans.

The above are general comments and may vary depending on some borrowers needs and financial ability. Please contact us for details regarding any specifics you may have.